Laying the foundation

The end of a commercial real estate lease can be a very stressful affair for both parties, a divorce if you like.

The tenant is wondering whether or not they have made the right decision to relocate, will staff be retained, have they been inclusionary in their decision-making process and will the new landlord fulfill their obligations retained in the new lease agreement.a

The landlord on the other hand is questioning whether or not they did all they could to retain said tenant, what will be the strategy to fill the gap as quickly as possible, what will the marketing approach be to best showcase the space with the commercial property arena and how will this vacancy effect the performance of their portfolio?

All very simple right?

It does not seem that way, we have found.

We explore our recent experiences with YOU, the market.

And when we say market, we mean ALL the stakeholders we have engaged with from Landlords, brokers and marketing people, design and build organisations, CID managers to, of course, the TENANTS (the client)

Please click on the link below for more insights by Will Harris , CEO GMaven

Let’s explain our sample size

Johannesburg CBD and Pretoria CBD. A summary of our experience:

Rosebank surrounds

Landlord contacted Yes

Agent contacted Yes

Visited property Yes

Last tenants fitout In situ

State of property Shocking

Commentary

The property has been vacant for many years and it has had zero visual maintenance. Security was present however they had no access to ablution consumables or cleaning since the vacancy began.

This begs the question, has the unseen elements of the property been maintained with the lack of an income, such as:

• HVAC

• Fire suppression system

• Electrical

• Lifts

The previous tenant’s fit out is of a cellular nature and would not be appealing to any incoming tenant, so then why leave it in place and avoid showcasing the space to its true potential?

Potential tenant commentary

“If this is the state of the building now, what can we expect the service levels to be if we were a current tenant of the property? The property was viewed by our firm and we dismissed it immediately”. CEO Large financial/legal firm.

Bryanston

Landlord contacted Yes

Agent contacted Yes

Visited property Yes

Last tenants fitout In situ

State of property Average

Commentary

The property has been vacant for a few years and is situated in a park with other buildings which have part tenancy.

The previous tenant’s fit out is of a part cellular and part open plan nature and is a 90’s style finish would not be appealing to any incoming tenant, so then why leave it in place and avoid showcasing the space to its true potential?

Potential tenant commentary

“We have better options in the market such as a newly vacated building adjacent to a popular shopping centre at similar rates and is not a rabbit warren”. Company CFO

Greenstone surrounds

Landlord contacted Yes

Agent contacted Yes

Visited property Yes

Last tenants fitout In situ

State of property Good

Commentary

The property has been vacant for a year and is a well located position, however lacks a few important components such as decent loading facilities and its office is larger than market norm.

The previous tenants fit out is in situ however each floor boasts a vastly different look and feel and so begs the question why it’s been left in place?

Midrand

Landlord contacted Yes

Agent contacted Yes

Visited property Yes

Last tenants fitout In situ

State of property Good

Commentary

The property has been vacant for a year and is a well-located position, however, it is a multi-functional and multi-building complex.

The previous tenant’s fit-out is in situ and is 20 years old, so begs the question why it’s been left in place?

Pretoria surrounds

Landlord contacted Yes

Agent contacted Yes

Visited property Yes

Last tenants fitout In situ

State of property shocking

Commentary

The property has been vacant for many years and is a well located position, is in an area where medium business are locating to and from the CBD and is on a prime corner.

The previous tenant’s fit out is in situ and is 20 years old, so begs the question why it’s been left in place?

Two Retail Centres

Northern Suburbs 1

All vacant space has been left with the previous tenant’s fitout and the centre looks uncared for and requires a refresh in property manager/asset manager as this does not seem to be working

Northern Suburbs 2

Less than two kilometres away from each other, this centre has an up and coming vacancy and they are planning to whitebox the space in preparation of a new tenant. All other tenants have survived including a massive bespoke restaurant.

This is a good sample size and its across different ownership structures, from private owners to large REITs and huge unlisted funds.

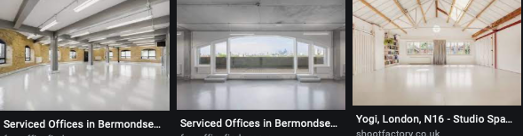

Global Standards

Let’s start by sharing some standards in respect of global cities that have a common practice when spaces are vacated.

More often than not, tenants are compelled to return the space in either a white or greybox state.

Whitebox

Typical whiteboxing state:

Removal of all fixtures Electrical

Floor finish Mechanical

Wall finish Hydraulic

Ceiling condition Fire suppression

Lighting grid Front door finish

Four Phases of Remediation

Greybox

Greyboxing is basically whiteboxing but with specific requirements from the landlords. The landlord may require specific flooring which a tenant may or may not use but it obliged to return to its state when vacating the premises. Usually, big food chains require greyboxing.

What does this all say to any potential incoming tenants when the property has been either white or greyboxed (and brokers for that matter)?

If you look at the pictures our local brokers post of vacant spaces, they almost never showcase the interior of the building. Why is this? Because most of the time the interior still has the previous tenant’s fit out.

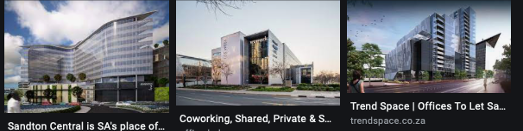

Comparing South Africa to the rest of the world

WE are not suggesting that we can miraculously create new demand that is not there, but what we are saying is that you are not giving yourself a more than equal chance of attracting tenants, given that your vacant space is a maze of old installation, not maintained and, to be honest, not ready for occupation.

We did a Google search for available space in three areas:

New York

London

Sandton

Let US Quote

Our journey included, as we have mentioned, all stakeholders in the real estate market and we have been overwhelmed by the complacency, apathy and zero tolerance for advice or engagement at any level.

We will give you some quotes from the players, you make your mind up whether you would want this company/individual promoting, managing, or maintaining your real estate assets:

Brokers

From a well-renowned broker who has many years of service to the real estate industry:

“Most Landlords are not whiteboxing as landlords do not want to spend a fortune on installations and want to use as much existing as possible”.

This Property has been vacant for 2 years and has had ZERO income.

From a leader of a large national property concern, whose business incorporates all service lines:

“This is a fantastic service and should form part of every landlord’s strategy and be incorporated in all leases as a tenant obligation. This would make our marketing functions a lot easier”.

Landlords

Medium size listed REIT:

“Our strategy currently is to exit our office portfolio and do not wish to spend any money on those assets”.

CEO of large REIT:

“You should talk to our property management company”.

Surely the function of a CEO should be to look at all their vacancies and manage their vacancies?

Design and Build companies

Business developer, Large influential D&B company:

“By the time we get the brief, all spaces should be devoid of all previous installations, why is this not a standard?”.

CEO of a large architectural and design and build firm:

“We will not undertake any job that entails using more than 20% of the existing installation on a new build. You know what they say ‘Goedkoop koop is duur koop’”.

We loved the honesty here. 🙂

The tenant has the last word

Just remember that interest in a property is the start of the journey, there are still many hurdles to overcome before you can claim you have secured a tenant. Having a competent team and network is the key to the success of the property and ultimately the portfolio.

Tenants are looking for any excuse to have a flexible lease whilst every results presentation by the listed funds has highlighted the Weighted Average Lease Expiry (WALE). Do you see the disconnect?

We have decided to highlight additional disconnects not to solicit more business, but to demonstrate the complete disregard to an already struggling real estate asset class, because we believe the line of responsibly is opaque. No one seems to take charge, and everyone is doing what they have always done.

We are speaking to tenants all day, because the real estate stakeholders are unwilling to engage properly to find alternative solutions to their vacancy issues, but simply waiting for the tenants to come knocking. They won’t.

They will talk with their feet, leave your unmanaged buildings, won’t consider your vacancies and simply base their businesses in new developments, in newer nodes leaving you to contemplate a redevelopment or repurposing opportunity.

What’s the answer?

We don’t know, but what we do know is that space looks dated, unappealing and it will remain vacant whilst your team and you remain vacant to new opportunities and new ideas.

Please take note: that this paper did not mention the C-word once 🙂

White Boxing SA

082 938 4795